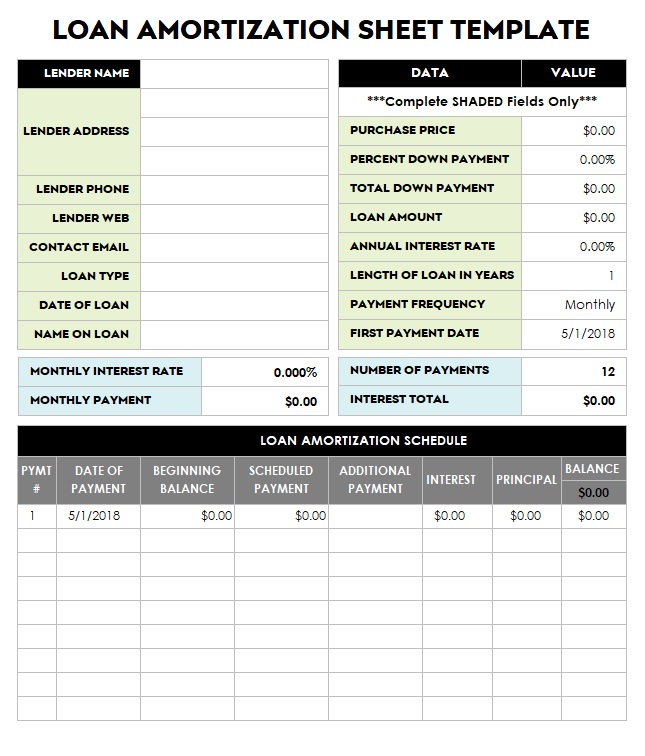

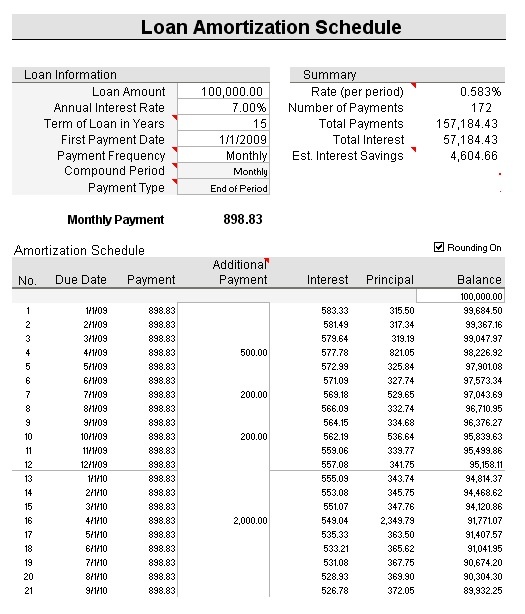

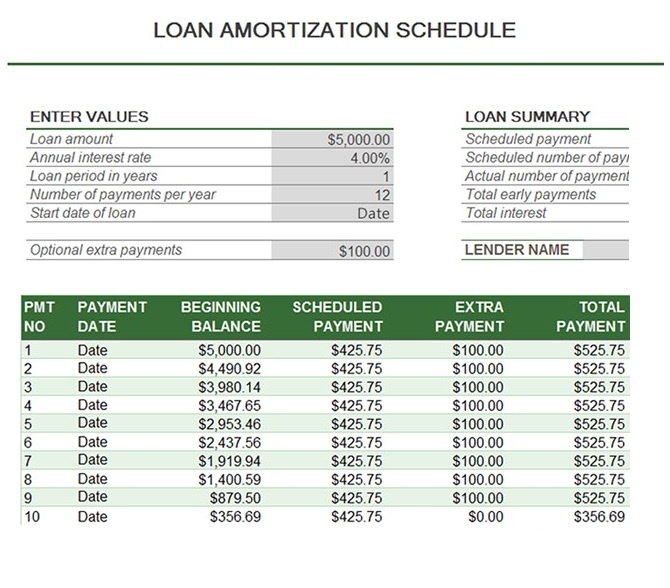

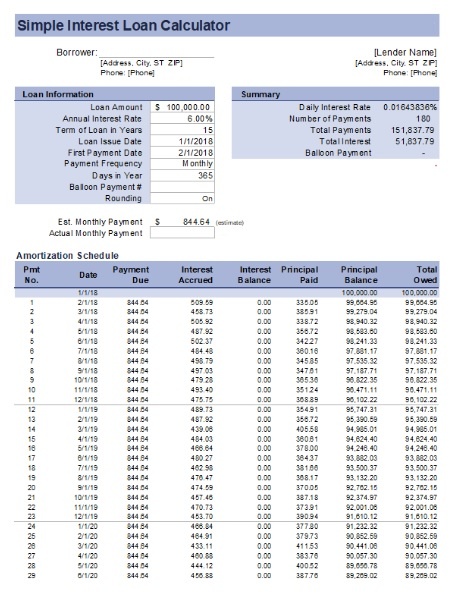

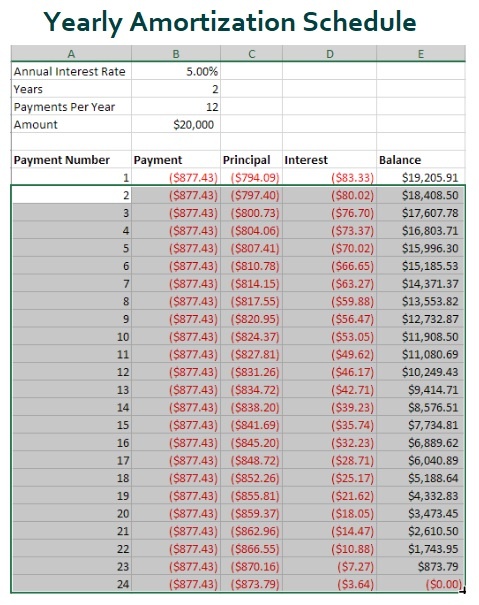

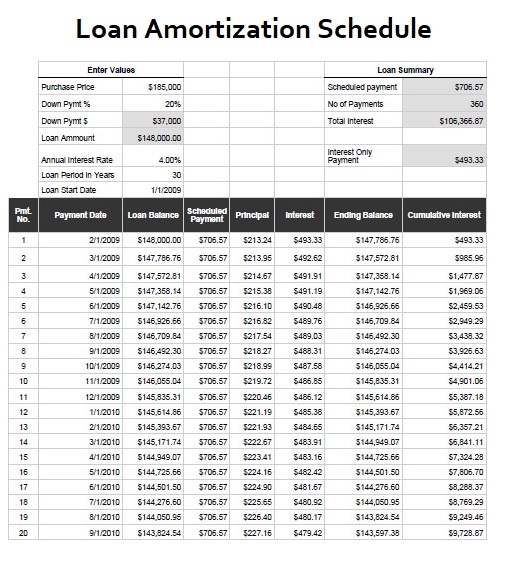

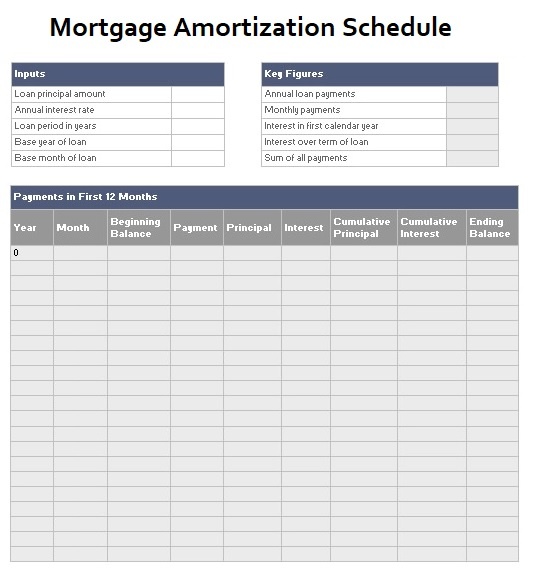

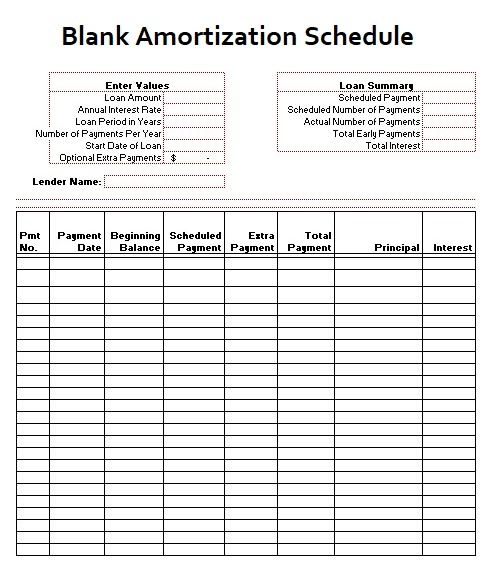

A loan amortization sheet template is a way to create your own sheet and find out your liabilities and interest payments for a certain time period. Basically, this sheet enables users to periodically view their installments or loan payments which need to be paid before the last date. Moreover, it highlights the current principal amount to determine how long you need to pay installments until your loan is paid off. A loan amortization sheet template provides insight into the number of already paid installments along with interest payments. Similarly, to know your current minimum monthly installment payment, you will need to view your loan amortization sheet.

Importance of Loan Amortization Sheet:

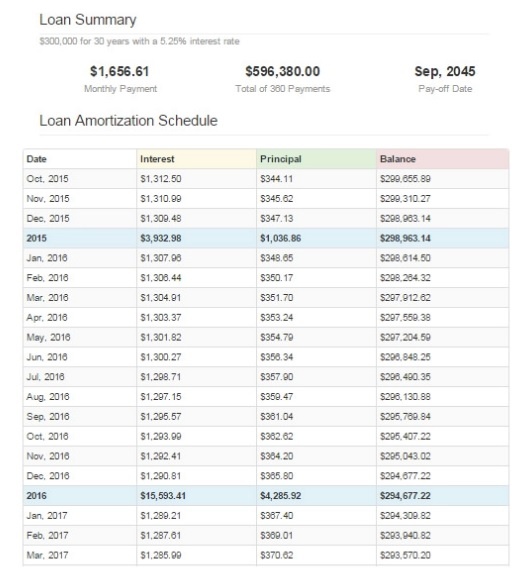

A loan amortization schedule sheet is a systematic process that ensures a borrower pays off a loan amount on agreed terms and time period. It includes details of monthly loan payments that cover the principal amount, mark-up amount and any other payment, like insurance. The mark-up amount or interest amount is basically the cost of the loan amount, which consists of a large portion of the total payment. Whereas, the insurance amount is often used to cover loss because of unforeseen events. As a result, it secures both the borrower and the lender in the long run. This sheet shows how gradually the principal amount and interest amount goes down with each payment. This is because the interest amount is based on the principal amount and with each loan payment, the principal amount also reduces. That is the reason why focusing on and using a loan amortization sheet is inevitable.

Essential aspects of a Loan Amortization Sheet:

The following are essential aspects of a loan amortization sheet:

Maturity Period of Loan:

A loan amortization schedule works only when it has a maturity date or period. It calculates the number of installments along with the mark-up amount based on the maturity period. The amount of loan repayment is based on the life of the loan. That means if a loan is long-term, then its installment amount will be lower as compared to the interest amount.

The cost of loan:

The cost of a loan, which is usually called interest amount, is based on a rate, like 5% or 10%. This rate contributes a major role in calculating monthly loan payments. The higher rate will increase your monthly loan payment where a lower rate reduces it.